For some customers, the licensing scheme VMware announced for vSphere 5 last month was a turning point.

After years of having VMware abstract the lock-in enforced by traditional software vendors, their favourite enterprise software vendor appeared to have changed course.

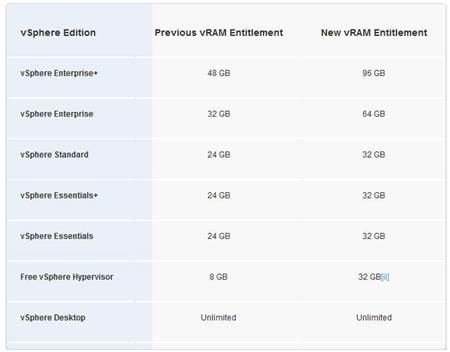

Under the new licensing scheme announced in mid-July, VMware would license per processor and associated virtual memory (vRAM), while removing previous limitations on physical cores and memory.

VMware’s executives felt the licensing change was innocuous – but VMware users that had built or planned memory-intensive infrastructure stacks were outraged, as it doubled or in some cases tripled their licensing costs.

The hashtag “#vTax” trended on Twitter, and threads on the topic on VMware’s user forums numbered in the thousands.

Michael Warrilow, senior manager or products and solutions at VMware Australia said the company’s executives had only the best intentions and sought the least disruptive licensing change they could come up with.

The new licensing scheme effectively relieved customers of restrictions around physical entitlements, such as the number of cores or amount of physical memory included within a given license.

This was particularly pertinent for those customers buying the latest generation of eight-core servers on VMware licenses that limited them to six cores – creating a tax of sorts for those at the bleeding edge of hardware adoption.

“We chose a non-disruptive tweaking of our licensing model,” Warrilow said. “But in retrospect, the bigger picture we feared – and created – was confusion.”

Most customers, far in excess of ninety percent, Warrilow claimed, had more than enough memory headroom under the new scheme. Based on a survey of 880 customers, VMware found that the average vSphere customer used only 4GB of virtual memory.

But many customers had hardware upgrades planned over the coming six to nine months for servers they expected to cycle until 2014 or 2015, and these roadmaps had been developed with the VMware 4.1 licensing model in mind.

Some of those customers reported pushing virtual memory allocations to 192GB or 256GB – the most extreme was a four-socket server with 768GB of virtual memory.

It rankled a good deal of those customers when VMware sales representatives responded to their complaints with advice that they should “right-size” their “monster boxes”.

The customers argued that consolidation and scale were among their main reasons for choosing VMware.

“Now VMware wants to punish us for using their product as they advertised,” quipped one complainant.

“The net effect of this vRAM fee on enterprise clients is that it discourages us financially from deploying super green high-density solutions which are the most cost, power, space efficient and environmental friendly,” said another.

Warrilow said the vendor was not aware of the extent of the “massive explosion in high memory configured boxes” out in the market.

Within days, he said, VMware executives realised the company “needed to find an equitable balance” between the needs of these customers and “the best interests of our business and shareholders.”

In response, VMware doubled the vRAM entitlement for Enterprise and Enterprise+ specifically to meet the needs of customers with “honking big boxes.”

The vendor also adjusted the licensing scheme to ensure customers would not be caught out by spiky workloads. There would be no hard ceiling on vRAM use – rather, the customer would be charged via a calculation that averages out the high water mark of vRAM use over 365 days.

That meant that customers with busy end-of-month processing days could burst above their entitlement without necessarily having to pay for another license.

This placated users whose environments fell within the boundaries of the vRAM entitlements today.

Those sympathetic to VMware have argued that the vendor had to begin to charge on the basis of capacity, as customers would otherwise continue to pack more virtual machines on less and less hosts to avoid paying more under the per-core licensing charges.

VMware’s swift conciliatory response to the crisis, they said, was another example of why VMware was different: a vendor willing to listen to its customers and adapt accordingly.

But not every customer was so easily swayed.

Some speculated that VMware had always intended to move to the prices that it introduced as a 'revision' this month, and the mid-July announcement was simply a way of softening the blow.

“These are the same limits that were in the PDF document [VMware] sent to me about a month ago when I first started complaining about this, so it is almost like they already knew they were going to change the limit to 96GB,” said one poster on the VMware forum.

Warrilow disputed that claim. The scheduling was confused by “a whole series of boring admin”, he said, including VMware’s requirement to provide distributors pricing 30 days prior to launch and OEM hardware vendors 90 days prior to launch.

“I can categorically state that there was no cunning testing of the market,” he said. “This was a total response to honest and genuine feedback, and I’m quite proud of the way we’ve done it.

“We have been updating hundreds of documents, even today.”

Warrilow chalked the experience up as a lesson learned for the vendor.

“As VMware becomes more important in production environments, we need to give more advanced notice for licensing changes that impact business critical workloads.”

The only question Warrilow couldn’t answer related to the Support and Subscription packages taken up by nearly every vSphere customer, packages that offer an upgrade to the next version of the product “at no extra cost”.

Clearly, for those customers using memory-intensive applications, there would be a significant extra cost to upgrading to vSphere 5. Would they be offered a refund of their Support and Subscription charges?

“I think you’d need a lawyer to answer that question,” Warrilow said.

Will the fracas change the way customers feel about VMware? Read on for more...

_(21).jpg&h=142&w=230&c=1&s=1)

_(27).jpg&h=142&w=230&c=1&s=1)

.jpg&w=100&c=1&s=0)